The smartphone industry is a very unpredictable place at times, especially with the recent trend of declining sales figures over the past couple of years. While that’s not to say that most folks have stopped buying newer smartphones entirely, it’s hard to deny that more buyers are keeping their phones for longing, instead of opting for annual device upgrades (as has been the norm for some).

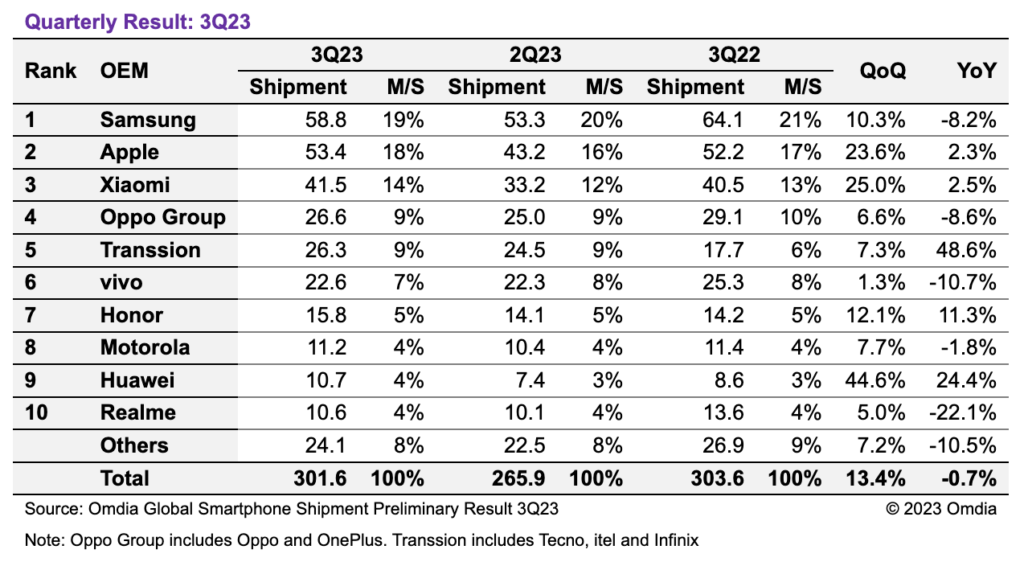

With that in mind, a recent finding from the good folks over at Omdia shows that the smartphone market experienced a 0.7% decrease in terms of sales during Q3 2023, compared to the same timeframe last year. However, newer data shows that preliminary smartphone shipment reports for Q3 of this year totalled 301.6 million units, although this is an interesting 13.4% increase versus Q2 2023.

Wins and Losses

Additionally, several smartphone OEMs saw considerable growth recently, including brands such as Apple, Xiaomi, Transsion Holdings Group, Honor and Huawei. Meanwhile, Samsung, vivo and Realme experienced large declines in overall shipments. Jusy Hong, Senior Research Manager at Omdia states:

“In China, Apple’s main market, the sales situation for the new iPhone has become difficult due to the launch of Huawei’s new 5G flagship smartphones and political issues. Nevertheless, Apple’s shipments in the fourth quarter and overall this year are expected to increase compared to last year due to the steady increase in premium demand and meaning hardware upgrades of iPhone 15 standard model.”

According to Omdia, this new information marks the ninth consecutive quarter of year-on-year declines in smartphone shipments, following a period of strong smartphone demand seen after the COVID-19 pandemic back in Q4 2020 and Q3 2021. As a result, the market has not been able to keep up with that expansion due to several factors, including production problems in China as well as a high inflation shrinking consumer confidence and demand.

Considerable Shifts

With that being said, Samsung still had the most shipments in Q3 2023 with 58.8 million shipments, a 10.3% increase from Q2 2023. Meanwhile, Apple recovered from its Q2 2023 with a 23.6% increase quarter-on-quarter and 2.3% year-on-year with 53.4 million units.

Xiaomi’s market share is recovering with 41.5 million shipments in Q3 2023, a 25% increase from the previous quarter and a 2.5% increase from the past year. Meanwhile, Oppo Group, which includes both the Oppo and OnePlus recorded 26.6 million shipments in Q3 2023, an 8.6% fall from the past year.

Transsion Holding increased a further 7.3% from Q2 2023 with a total of 26.3 million in Q3 2023, a 48.6% increase from the past year. This has resulted in Vivo being pushed into sixth place by Transsion, with a 10.7% fall in shipments from 25.3 million in Q3 2022 to 22.6 million in Q3 2023. Honor on the other hand has continued its sustained growth throughout 2023, with 15.8 million unit shipments in Q3 2023.

Realme managed to ship 10.6 million units in Q3 2023, marking a 22.1% fall from the previous year – Realme has experienced the largest percentage drop in its shipments throughout 2023 so far with a 30.5% drop compared to shipments from last year.

Huawei has managed to fare nicely, with 10.7 million shipments in Q3 2023, a 24.4% increase from last year. Based on these figures, Huawei has performed well against very tough market conditions to secure the tenth spot in Omdia’s shipment rankings.

A Chance to Recuperate

With all this being said, it’s still likely that the smartphone market will experience considerable recovery in the coming months, at least in terms of overall shipments and sales figures. Hong adds:

“The smartphone industry remains slightly below the shipment total we saw in 3Q22, however there are already signs of a recovering market. Half of all major brands saw increased shipments compared to the past year, with Transsion, Honor and Huawei particularly exceeding. It’s therefore clear that problems that have been facing the smartphone industry in 2023 are coming to an end; inflation is slowing globally, and with which consumers’ confidence is also growing.

The whole market is down 7.5% so far in 2023 compared to the first three quarters of 2022, meaning the final 2023 total is likely to be below that of 2022. But there are signals that a slow recovery is already underway.”