When it comes to consumer products, smartphones rank among the most popular tech, given the massive fanfare behind big brands like Apple, Samsung, and such. With the massive shift in world economies over the past couple of years however, recent studies have shown that people have been buying less phones as compared to previous years.

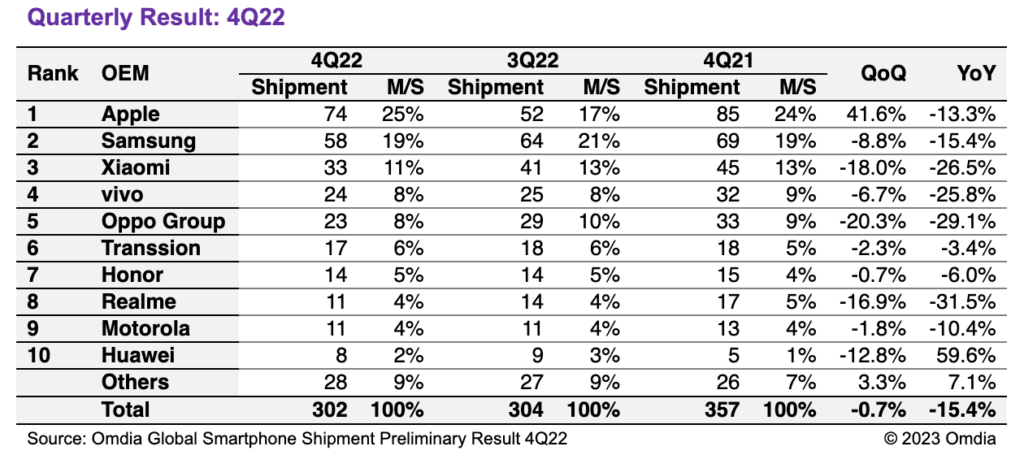

New data from research organization Omdia shows that smartphone preliminary shipment reports during the final quarter of 2022 totalled 301.5 million units, marking a decrease of 15.4% compared to the previous year. While the last quarter usually sees the most shipments, last year’s final quarter changed with a 0.7% decrease compared to the previous quarter, with several OEMs exhibiting negative growth alongside double-digit falls in shipments.

Apple recorded the most shipments at 74 million, which is a significant 41.6% increase from the third quarter of 2022, but still a 13.3% fall compared to the jump in shipments seen in 4Q21. However, Apple’s market share increased YoY from 24% in 4Q21 to 25% in 4Q22 with other OEMs experiencing similar or greater falls. According to Jusy Hong, Senior Research Manager at Omdia:

“Apple seemed to be the one OEM resisting the overall decline in the wider market in the first three quarters of 2022, but it has now finally succumbed to the overall market conditions. Because its consumers are typically loyal and high-income customers, it was expected that the cost-of-living crisis wouldn’t affect Apple shipments in the same way it effects low and mid-range brands. But now, with the effects of inflation and production disruptions, Apple’s fourth quarter bump in 2022 is disappointingly small compared to the previous year. Despite this, early demand and customer feedback for the latest iPhone 14 Pro and 14 Pro Max has been really strong, thanks to a new front-facing display called Dynamic Island. Apple was confident in strong demand and had planned maximum production for these two models to counteract it. However, the suspension of production at the Foxconn plant put a damper on this.”

Samsung meanwhile falls to second place due to a 15.4% fall YoY, recording 58 million shipments in 4Q22 compared to 69 million in 4Q21. It also saw an 8.8% fall from the previous quarter, down from 64 million, albeit with a relatively-stable market share.

Other OEMs including Xiaomi, Vivo, and Oppo, also recorded a decline of more than 25% in the fourth quarter compared to same period in the previous year. Xiaomi remains the third largest smartphone OEM by shipments, with 33 million recorded in 4Q22, although a significant fall from both the previous quarter (41 million in 3Q22, a 18.0% fall) and the previous year (45 million in 4Q21, a 26.5% fall).

Oppo Group (which includes Oppo and OnePlus) and vivo swapped fourth and fifth place – vivo shipped 24 million units in 4Q22, a minor fall from 25 million in 3Q22, but a considerable 25.8% fall from the 32 million units shipped in the previous year. Oppo Group saw an even bigger fall down from 29 million in the previous quarter to 23 million in the fourth quarter, amounting to a 20.3% fall. Compared to the previous year, it is a 29.1% fall from 33 million.

Both Transsion (which includes Tecno, itel and Infinix) and Honor seem to be more resilient than other Chinese OEMS, with Transsion having the sixth highest shipment figures in the latest quarter, recording 17 million units, a slight fall from the 18 million recorded in both the previous quarter and year. Honor’s shipments in the fourth quarter totaled 14 million units, a slight fall from the 15 million units in the previous year.

Realme took eighth place, with 11 million units, falling 16.9% from the previous quarter and a massive 31.5% fall from the previous year. Zaker Li, Principal Analyst at Omdia attributes this downward trend in Chinese OEM shipments to several factors:

“A variety of things are causing the continued slump in Chinese OEM shipments, including a local economy recession, pandemic-related lockdown of major Chinese cities, and the sudden abandonment of the Zero-Covid policy has brought confusion to the market. Internationally, high inflation is cutting consumers’ disposable incomes, which negatively impacts Chinese OEMs who primarily target the low to mid-end price range. Many Chinese OEMs also continue to struggle in the Indian smartphone market, the largest international market for a number of brands. An unintended consequence of this reduction in demand was a significant increase in inventory. As a result, it is not surprising that OEMs are downgrading their shipment targets for each quarter, with this likely to continue for at least another two quarters.”

Motorola remains in ninth place with 11 million units, with a 10.4% fall from the previous year. Huawei holds its place in tenth place despite a fall in shipments for the first time in a year, recording 7.5 million units compared to the previous quarter’s 8.6 million. But this fall doesn’t erode the improvements the company has made in the past year, with this still representing a 59.6% increase YoY.

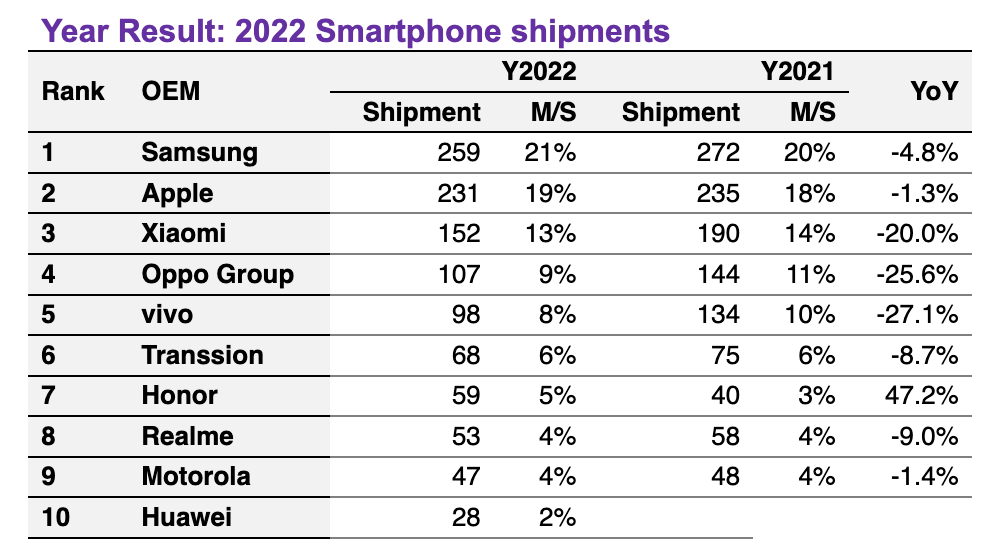

There were 1,207 million recorded shipments across 2022, amounting to a fall of 9.9% from the 1,340 million shipments recorded in 2021. Honor was the only major set OEM to see growth, recording 59 million in 2022 compared to 40 million in 2021. American brands Apple and Motorola were the two OEMs most resilient to the general trend of decline, each seeing small falls of 1.3% and 1.4% respectively. Samsung’s final recorded shipments in 2022 are 259 million, the most of any OEM, but this is still a 4.8% fall from the 272 million recorded in 2021. Those most hit were the Chinese set OEMs, with Xiaomi, vivo and Oppo group all seeing significant double-digit falls in shipments YoY.

Hong points out that Omdia’s predicted drop in OEM shipments and targets is also affected by additional factors:

“…the key driver is inflation squeezing wage packets and reducing disposable income. A strong dollar against other currencies also discourages OEM’s profitability and dampens promotions and marketing activities. On the production side, high inventories and low demand is resulting in continued reductions in production volumes. It will take time for the market to recover, with an increase in shipments unlikely until at least the third quarter of 2023.”